Everything about Financial Advisor

Wiki Article

The Single Strategy To Use For Financial Advisor Meaning

Table of ContentsSome Known Factual Statements About Financial Advisor Job Description Not known Facts About Financial Advisor Near MeFinancial Advisor Meaning Fundamentals ExplainedThe Best Strategy To Use For Financial Advisor Meaning

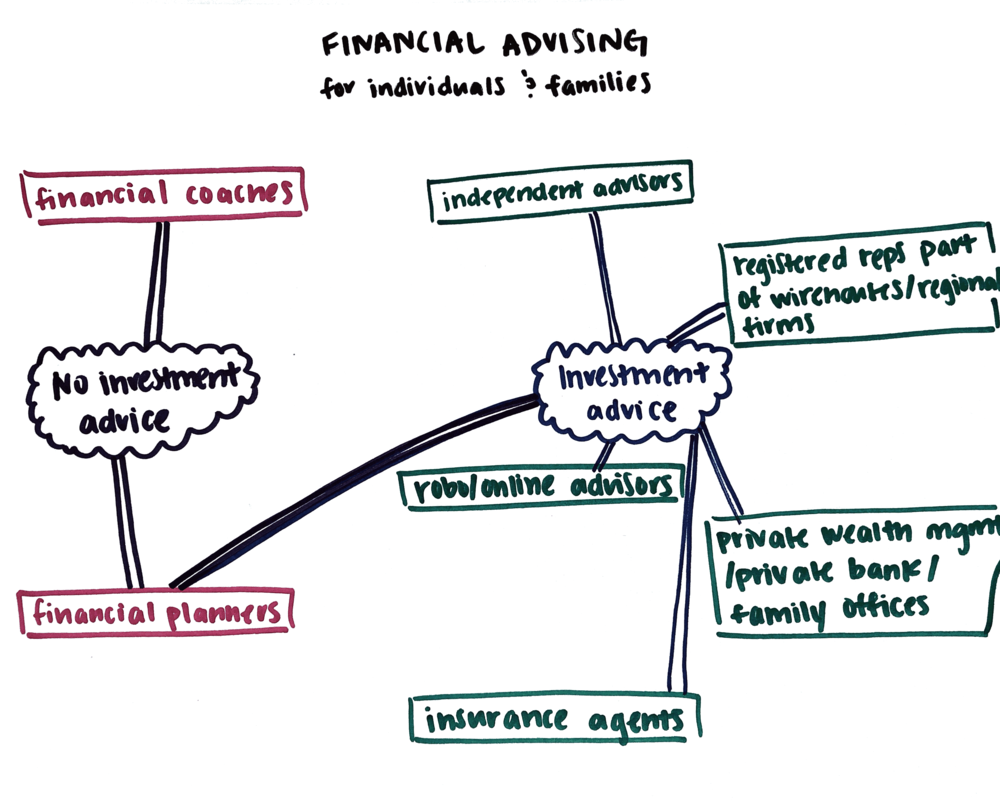

There are numerous kinds of monetary consultants out there, each with varying qualifications, specialties, and also levels of accountability. And also when you're on the quest for a specialist matched to your demands, it's not unusual to ask, "How do I understand which financial advisor is best for me?" The answer starts with a straightforward accountancy of your needs and a little of study.Kinds of Financial Advisors to Consider Depending on your financial needs, you might choose for a generalized or specialized economic consultant. As you start to dive right into the world of looking for out an economic advisor that fits your needs, you will likely be presented with lots of titles leaving you wondering if you are speaking to the appropriate individual.

It is essential to keep in mind that some monetary experts likewise have broker licenses (meaning they can market protections), yet they are not entirely brokers. On the exact same note, brokers are not all licensed similarly as well as are not economic consultants. This is simply one of the several factors it is best to begin with a certified monetary coordinator that can recommend you on your investments as well as retirement.

Financial Advisor Fees Things To Know Before You Get This

Unlike financial investment experts, brokers are not paid straight by clients, instead, they gain compensations for trading stocks and also bonds, as well as for marketing common funds as well as other products.

An accredited estate organizer (AEP) is an expert that specializes in estate planning. When you're looking for a monetary advisor, it's good to have a suggestion what you desire help with.

Just like "financial expert," "financial organizer" is additionally a wide term. A person keeping that title could likewise have various other accreditations or specializeds. Despite your certain requirements as well as monetary situation, one requirements you ought to highly think about is whether a potential consultant is a fiduciary. It might amaze you to find out that not all financial experts are required to useful content act in their clients' finest interests.

The 7-Second Trick For Financial Advisor Salary

To secure yourself from someone who is simply attempting to obtain more money from you, it's a good suggestion to search for an advisor that is registered as a fiduciary. An economic advisor that is signed up as a fiduciary is required, by regulation, to act in the very best interests of a client.Fiduciaries can only suggest you to utilize such products if they believe it's really the very best economic decision for you to do so. The United State Securities and Exchange Payment (SEC) regulates fiduciaries. Fiduciaries that fall short to act in a client's benefits might be hit with penalties and/or jail time of up to 10 years.

That isn't since anybody can get them. Getting either certification needs somebody to experience a selection of courses and also examinations, along with making a set amount of hands-on experience. The outcome of the certification process is that CFPs and Ch, FCs are go to this website skilled in topics across the field of personal money.

The cost might be 1. 5% for AUM between $0 YOURURL.com and also $1 million, but 1% for all possessions over $1 million. Charges generally decrease as AUM boosts. An advisor that earns money only from this monitoring charge is a fee-only expert. The option is a fee-based consultant. They seem similar, but there's a vital distinction.

The Definitive Guide to Financial Advisor

An expert's management charge might or may not cover the prices associated with trading safety and securities. Some advisors likewise charge a set cost per transaction.

This is a service where the advisor will bundle all account administration costs, including trading charges as well as cost ratios, into one extensive charge. Since this cost covers extra, it is generally higher than a charge that only includes management and also leaves out points like trading prices. Cover costs are appealing for their simpleness but also aren't worth the cost for everyone.

While a typical advisor normally bills a cost between 1% as well as 2% of AUM, the charge for a robo-advisor is typically 0. The huge compromise with a robo-advisor is that you often don't have the ability to talk with a human advisor.

Report this wiki page